Bitcoin (BTC) traders just over $81,500 in Asian morning hours Monday as a weekend slide saw major tokens lose momentum on last week’s brief rally.

XRP and Cardano’s ADA led losses among majors with a 5% drop in the past 24 hours, with Solana’s SOL, dogecoin (DOGE) and ether (ETH) down between 2-3%.

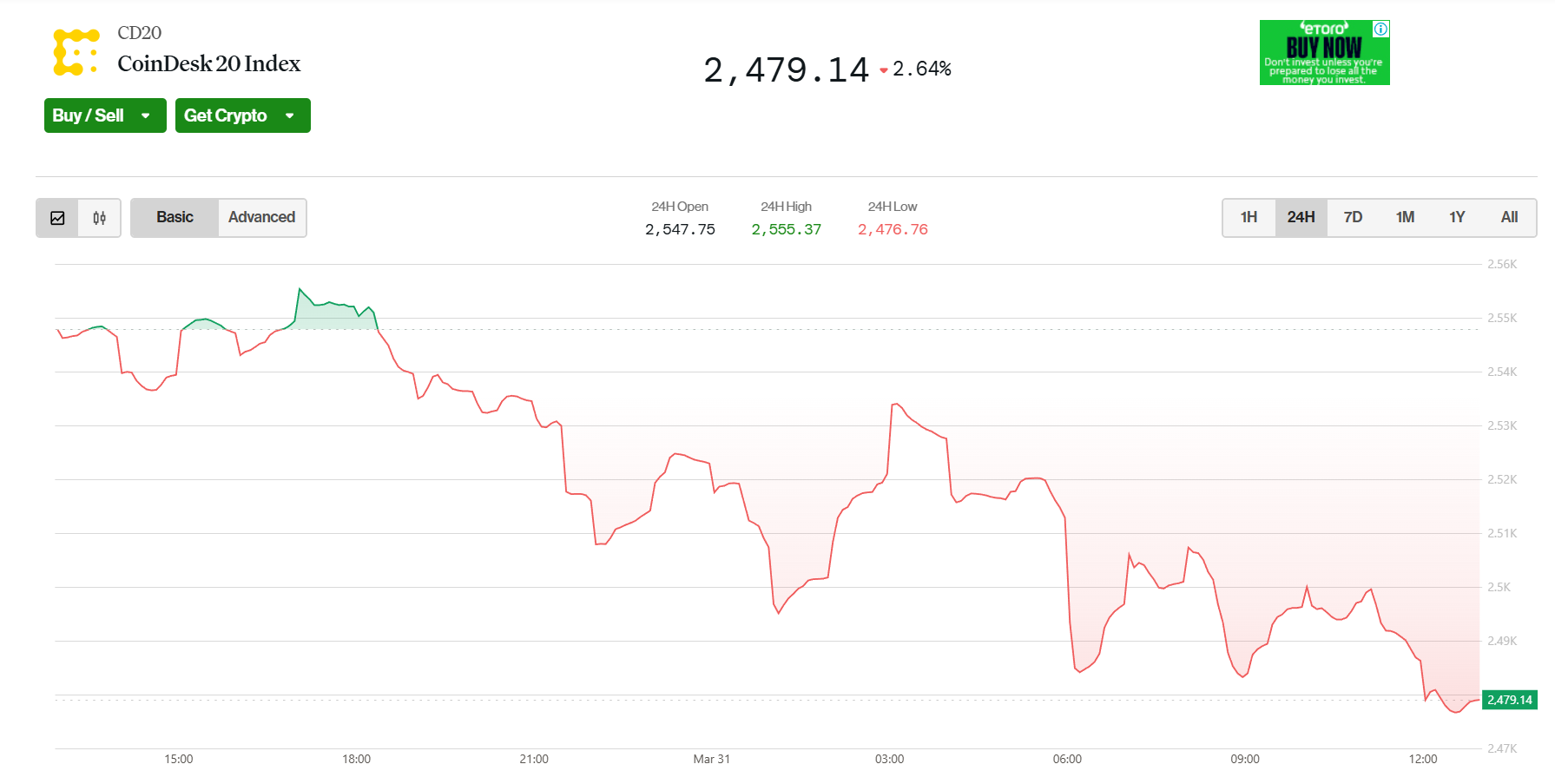

The CoinDesk 20, a measure of the performance of the largest digital assets, is down 2.6%

Stock markets opened lower Monday, their fourth consecutive day of decline, as investors around the globe brace for President Donald Trump’s upcoming announcement of new tariffs, set to be revealed on April 2, amid growing fears of a global trade war’s economic fallout.

Hong Kong’s Hang Seng index was down 1..7% in the morning session, while the Nikkei 225 was down 3.8%, and Korea’s KOPSI index in the red by 3% as export-heavy economies worry about market access to the U.S.

Futures for U.S. and European stock indexes also fell. In contrast, safe-haven assets like gold reached an all-time high, and U.S. Treasury yields dropped due to increased demand.

Globally, portfolio managers are adopting cautious strategies, either reducing risk or avoiding large investments, unsettled by the impending “reciprocal tariffs” and their potential economic toll.