On-chain data shows the Bitcoin network has witnessed a spike in profit-taking activity from investors, but so far, the price has managed to hold.

Bitcoin Saw Multiple Profit-Taking Spikes Of $500 Million Per Hour Recently

According to data from the on-chain analytics firm Glassnode, the Realized Profit indicator has registered multiple large spikes for Bitcoin recently. The “Realized Profit” here refers to an on-chain indicator that keeps track of the total amount of profit that the BTC investors are ‘realizing’ through their transfers on the network.

The metric works by going through the transfer history of each coin being sold or moved to see what price it was transacted at prior to this. If this previous transaction price is less than the current selling price for any token, then that particular coin’s sale is leading to the realization of a gain equal to the difference between the two values.

The Realized Profit sums up this difference for all profit-taking moves to determine the total for the network. A counterpart indicator called the Realized Loss takes care of the sales of the opposite type.

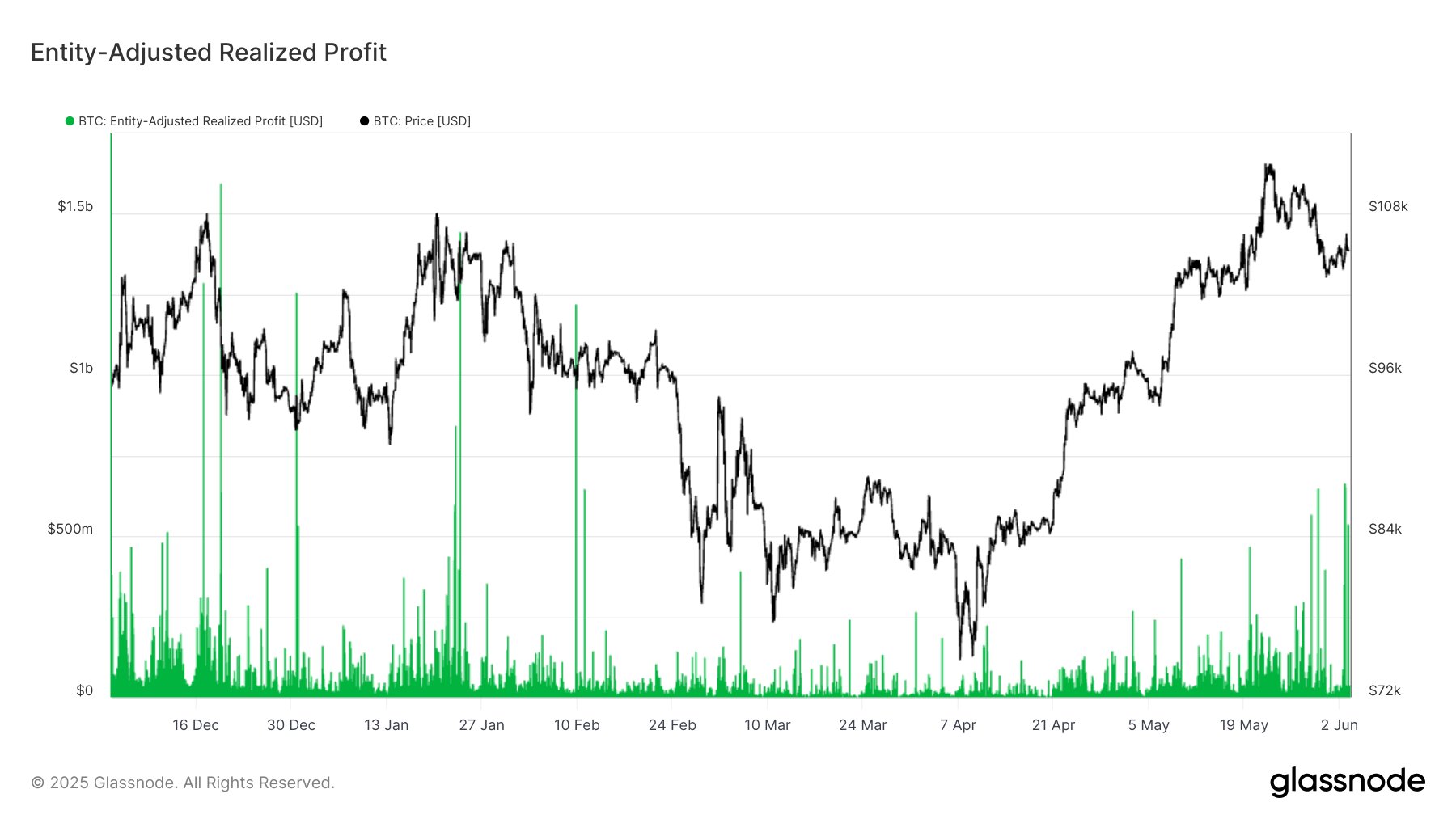

Now, here is the chart shared by the analytics firm that shows the trend in the Bitcoin Realized Profit over the past few months:

Note that the version of the Realized Profit in the chart is the “Entity-Adjusted” one, meaning it tracks not only the transfers occurring between different wallets but also the transfers between different entities.

Glassnode defines an ‘entity’ as a cluster of addresses that it has determined to belong to the same investor through its analysis. Naturally, moves happening between the wallets of the same owner don’t reflect the realization of any profit, so accounting for entities cleans out the data.

As visible in the graph, the Bitcoin Entity-Adjusted Realized Profit experienced several large spikes toward the end of last month, indicating that investors took a significant amount of profit. These spikes coincided with the asset’s decline from its near-ATH levels, so it’s possible that this selling may have been the trigger for it.

Now, the indicator has experienced a few more of these spikes, corresponding to profit-taking sprees exceeding $500 million per hour. Thus, it would seem that the investors aren’t yet done harvesting their gains.

This time, however, Bitcoin hasn’t seen a move down so far. It only remains to be seen, though, how long this would last if spikes in the Realized Profit continue to emerge.

BTC Price

At the time of writing, Bitcoin is floating around $104,900, down almost 4% in the last seven days.